China IoT Market by Hardware (Processor, Memory, Logic, Sensor, & Connectivity), Software (Real-Time Streaming, Network Security, Data Management, Remote Monitoring, & Bandwidth Management), Platform, Service, and Application - Global Forecast to 2022

The China IoT market is expected to grow from USD 11.00 Billion in 2015 to USD 121.45 Billion by 2022, at a CAGR of 41.1% between 2016 and 2022. The base year considered for the study is 2015 and the forecast is provided for the period between 2016 and 2022. The objective of the report is to provide a detailed analysis of the market based on hardware, software, platform, service, and application. To estimate the size of the China IoT market, top players and their shares in the market have been considered.

System Analysis

- Further breakdown of the application segment, by processing

- Further breakdown of the application segment, by sensor

- Further breakdown of the application segment, by connectivity

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

The China IoT market is expected to have a high growth potential till 2022. The total market is expected to reach USD 121.45 Billion by 2022 from USD 11.00 Billion in 2015, at a CAGR of 41.1% between 2016 and 2022. The major driving factors for the growth of the market are the growing demand for smartphones and other connecting devices, increasing internet penetration, rising trends of industrial automation, and mainstream adoption of cloud computing.

This report covers the China IoT market on the basis of hardware, software, platform, service, and application. The automotive & transportation application holds the largest share of the market on the basis of application. IoT assist states, cities, and towns across the China to meet the increasing demand for the surface transportation system. This application assists in enhanced speed monitoring, traffic counting, presence detection, headway measurement, navigation, and vehicle classification. Professional services hold the largest market size in terms of application.

The market for managed services is expected to grow at the highest CAGR during the forecast period. These services are crucial as they are directly related to customer experience and help the companies sustain their positions in the market. Managed services offer technical skills that are required to maintain and update software in the IoT ecosystem.

In the software segment, data management is the largest for IoT in China. It plays a vital role in the overall China IoT market as IoT devices produce enormous amounts of data that pose a challenge for the providers to deal with efficiently. To generate insights from the huge amount of data, organizations require data management solutions to manage structured as well as unstructured data.

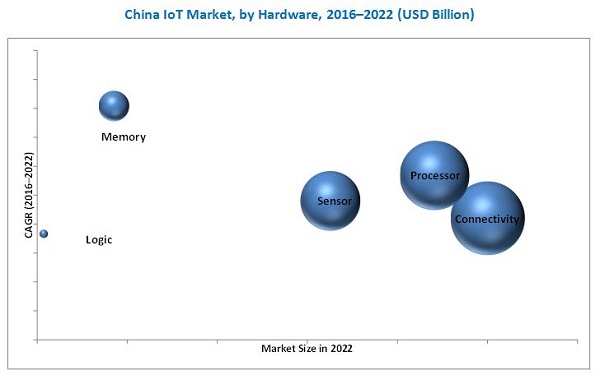

In terms of hardware, the market for memory devices is expected to grow at the highest CAGR during the forecast period. As the data in IoT devices need to be constantly updated, the endurance of memory devices is an important parameter. Memory devices are increasingly being adopted in the Chino IoT with the introduction of low-power-consuming and high-performance chips. In the platform segment, the device management platform is estimated to hold the largest market size and to grow at the highest CAGR during the forecast period. The device management platform assists organizations in managing, tracking, securing, and sustaining the abundant devices that are used in the organizations.

The complex network infrastructure of IoT and high power consumption by connected devices are the major restraining factors for the China IoT market.

The China IoT includes companies for major hardware providers such as Xiaomi Inc. (China), Qualcomm Incorporated (U.S.), MediaTek Inc. (Taiwan), and Huawei Investment & Holding Co., Ltd. (China); network providers such as China Mobile Limited (Hong Kong), China Unicom (Hong Kong) Ltd. (Hong Kong), and China Telecom Corporation Limited (Beijing); and software providers such as International Business Machines (IBM) Corporation (U.S.), Microsoft Corporation (U.S.), and Alibaba Group Holding Ltd. (China). These players adopted various strategies such as new product developments, partnerships, collaborations, and business expansions to cater to the needs of this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

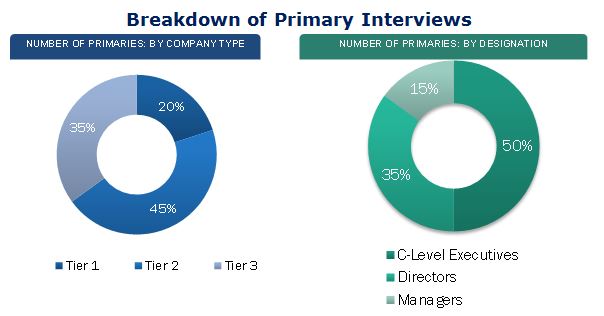

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Chiina IoT Market

4.2 China IoT Market, By Component

4.3 Market, By Hardware and Software

4.4 Market Size, By Application

4.5 China 12th Five–Year Plan’s Offerings for IoT Industry

4.6 China 13th Five–Year Plan’s Offerings for IoT Industry

4.7 Made in China 2025 Offerings for IoT Industry

4.8 Smart Cities in China

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 China IoT Market, By Hardware

5.3.2 Market, By Software

5.3.3 China IoT Market, By Platform

5.3.4 Market, By Service

5.3.5 China IoT Market, By Application

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Demand for Smartphones and Other Connecting Devices

5.4.1.2 Growing Use of Internet in China

5.4.1.3 Rising Trend of Industrial Automation

5.4.1.4 Mainstream Adoption of Cloud Computing

5.4.2 Restraints

5.4.2.1 Complex Network Infrastructure of IoT

5.4.2.2 High Power Consumption By Connected Devices

5.4.3 Opportunities

5.4.3.1 Adoption of IoT for Cross-Domain Applications

5.4.3.2 Emergence of Smart Cities in China

5.4.3.3 Introduction of Advanced Integrated Economical Solutions of IoT

5.4.3.4 Government Funding to Promote IoT in China

5.4.4 Challenges

5.4.4.1 Lack of Common Communication Standards Across Platforms

5.4.4.2 Increasing Concern Regarding Safety and Privacy of Data

6 Industry Trends (Page No. - 57)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Competitive Rivalry

6.4 China IoT Market Pestel Analysis

6.4.1 Introduction

6.4.2 Political Factors

6.4.3 Economic Factors

6.4.4 Social Factors

6.4.5 Technological Factors

6.4.6 Environmental Factors

6.4.7 Legal Factors

6.4.8 Conclusion

7 China IoT, Technology Analysis (Page No. - 73)

7.1 Introduction

7.2 Consumer Applications

7.2.1 Smart Homes

7.2.2 Home Automation Systems

7.2.3 Smart Thermostats

7.2.4 Smart Lighting

7.2.5 Smart Appliances

7.2.6 Smoke Detectors

7.2.7 Occupancy Sensors

7.2.8 Wearable Electronics

7.3 Public Applications

7.3.1 Building Automation & Controls Systems

7.3.2 IoT-Based Precision Farming

7.3.3 Smart Greenhouses

7.3.4 Intelligent Transportation Systems

7.4 Industrial Applications

7.4.1 Industrial IoT Market

7.4.2 Industrial Control & Factory Automation

7.4.3 Smart Factories

7.4.4 Retail Automation

8 China IoT Market, By Hardware (Page No. - 90)

8.1 Introduction

8.2 Processor

8.2.1 Microcontroller (MCU)

8.2.2 Application Processor

8.2.3 Digital Signal Processor (DSP)

8.3 Memory Device

8.4 Logic Device

8.5 Sensor

8.5.1 Heart Rate Sensor

8.5.2 Pressure Sensor

8.5.3 Temperature Sensor

8.5.4 Blood Glucose Sensor

8.5.5 Blood Oxygen Sensor

8.5.6 Electrocardiogram (ECG) Sensor

8.5.7 Humidity Sensor

8.5.8 Image Sensor

8.5.9 Gas Sensor

8.5.10 Ambient Light Sensor

8.5.11 Flow Sensor

8.5.12 Level Sensor

8.5.13 Chemical Sensor

8.5.14 Motion and Position Sensor

8.5.15 Soil Humidity Sensor

8.5.16 Soil Temperature Sensor

8.6 Connectivity IC

8.6.1 Ant+

8.6.2 Bluetooth

8.6.3 Bluetooth Smart/Bluetooth Low Energy (BLE)

8.6.4 Zigbee

8.6.5 Wireless Fidelity (Wi-Fi)

8.6.6 Ethernet

8.6.7 Near Field Communication (NFC)

8.6.8 Enocean

8.6.9 Cellular Network

8.6.10 Wireless Highway Addressable Remote Transducer Protocol (WHART)

8.6.11 Global Navigation Satellite System (GNSS) Module

8.6.12 Thread

8.6.13 Z-Wave

8.6.14 Isa 100

9 China IoT Market, By Software (Page No. - 103)

9.1 Introduction

9.2 Real-Time Streaming Analytics

9.3 Application and Network Security

9.4 Data Management

9.5 Remote Monitoring System

9.6 Network Bandwidth Management

10 China IoT Market, By Platform (Page No. - 109)

10.1 Introduction

10.2 Device Management Platform

10.3 Application Management Platform

10.4 Network Management Platform

11 China IoT Market, By Services (Page No. - 113)

11.1 Introduction

11.2 Professional Services

11.3 Managed Services

12 China IoT Market, By Application (Page No. - 117)

12.1 Introduction

12.2 Consumer Electronics

12.2.1 Products Covered Under Consumer Electronics Application

12.2.1.1 Activity Monitors

12.2.1.2 Smart Watches

12.2.1.3 Smart Glasses

12.2.1.4 Wearable Cameras

12.2.1.5 Smart Tvs

12.2.1.6 Refrigerators

12.2.1.7 Washing Machines

12.2.1.8 Other Products

12.3 Building Automation

12.3.1 Products Covered Under Building Automation Application

12.3.1.1 Occupancy Sensors

12.3.1.2 Daylight Sensors

12.3.1.3 Smart Thermostats

12.3.1.4 IP Cameras

12.3.1.5 Smart Meters

12.3.1.6 Smart Locks

12.3.1.7 Smoke Detectors

12.3.1.8 Lighting Control Actuators

12.4 Industrial

12.4.1 Products Covered Under Industrial Application

12.4.1.1 Industrial Motes

12.5 Automotive & Transportation

12.6 Healthcare

12.6.1 Products Covered Under Healthcare Application

12.6.1.1 Fitness & Heart Rate Monitors

12.6.1.2 Blood Pressure Monitors

12.6.1.3 Blood Glucose Meters

12.6.1.4 Continuous Glucose Monitors

12.6.1.5 Pulse Oximeters

12.6.1.6 Automated External Defibrillators

12.6.1.7 Programmable Syringe Pumps

12.6.1.8 Wearable Injectors

12.6.1.9 Multiparameter Monitors

12.7 Retail

12.7.1 Products Covered Under Retail Application

12.7.1.1 Smart Beacons

12.8 Oil & Gas

12.8.1 Products Covered Under Oil & Gas Application

12.8.1.1 Wireless Sensors

12.9 Agriculture

12.9.1 Products Covered Under Agriculture Application

12.9.1.1 Wireless Sensors

12.10 Other Applications

13 Competitive Landscape (Page No. - 139)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Scenario

13.3.1 New Product Launches

13.3.2 Acquisitions and Expansions

13.3.3 Partnerships

13.3.4 Agreements, Collaborations, Joint Ventures, and Strategic Alliances

14 Company Profiles (Page No. - 147)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 Hardware Providers

14.2.1 Huawei Investment & Holding Co., Ltd.

14.2.2 Mediatek Inc.

14.2.3 Qualcomm Inc.

14.2.4 Xiaomi Inc.

14.3 Software Providers

14.3.1 IBM Corp.

14.3.2 Microsoft Corp.

14.3.3 Alibaba Group Holding Ltd.

14.4 Network Providers

14.4.1 China Mobile Ltd.

14.4.2 China Unicom (Hong Kong) Ltd.

14.4.3 China Telecom Corp. Ltd.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 172)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (45 Tables)

Table 1 Global vs. China IoT Market Size, 2013–2022 (USD Billion)

Table 2 China IoT Market, By Component, 2013–2022 (USD Million)

Table 3 Chinese Cities Listed Under the First Pilot Smart City Project

Table 4 Porter’s Five Forces Analysis With Their Weightage Impact

Table 5 China: Country Snapshot

Table 6 Political Background of China

Table 7 Comparison of Economic Factors of China, for 2013, 2014, and 2015

Table 8 Demographics of China (2015)

Table 9 Analysis of Technological Influence on China (2015)

Table 10 Analysis of Environment of China

Table 11 China IoT Market, By Hardware, 2013–2022 (USD Million)

Table 12 Market for Hardware, By Application, 2013–2022 (USD Million)

Table 13 Market, By Processor, 2013–2022 (USD Million)

Table 14 China IoT Market, By Software, 2013–2022 (USD Million)

Table 15 Market for Software, By Application, 2013–2022 (USD Million)

Table 16 China IoT Market, By Platform, 2013–2022 (USD Million)

Table 17 Market for Platform, By Application, 2013–2022 (USD Million)

Table 18 China IoT Market, By Service, 2013–2022 (USD Million)

Table 19 Market for Service, By Application, 2013–2022 (USD Million)

Table 20 Market, By Application, 2013–2022 (USD Million)

Table 21 China IoT Market for Consumer Electronics Application,By Component, 2013–2022 (USD Million)

Table 22 Market for Consumer Electronics Application, By Hardware, 2013–2022 (USD Million)

Table 23 China IoT Market for Building Automation Application, By Component, 2013–2022 (USD Million)

Table 24 Market for Building Automation Application, By Hardware, 2013–2022 (USD Million)

Table 25 China IoT Market for Industrial Application, By Component,2013–2022 (USD Million)

Table 26 Market for Industrial Application, By Hardware,2013–2022 (USD Million)

Table 27 China IoT Market for Automotive & Transportation Application,By Component, 2013–2022 (USD Million)

Table 28 Market for Automotive & Transportation Application,By Hardware, 2013–2022 (USD Million)

Table 29 China IoT Market for Healthcare Application, By Component,2013–2022 (USD Million)

Table 30 Market for Healthcare Application, By Hardware,2013–2022 (USD Million)

Table 31 China IoT Market for Retail Application, By Component,2013–2022 (USD Million)

Table 32 Market for Retail Application, By Hardware,2013–2022 (USD Million)

Table 33 China IoT Market for Oil & Gas Application, By Component,2013–2022 (USD Million)

Table 34 Market for Oil & Gas Application, By Hardware,2013–2022 (USD Million)

Table 35 China IoT Market for Agriculture Application, By Component,2013–2022 (USD Million)

Table 36 Market for Agriculture Application, By Hardware,2013–2022 (USD Million)

Table 37 China IoT Market for Other Applications, By Component,2013–2022 (USD Million)

Table 38 Market for Other Applications, By Hardware,2013–2022 (USD Million)

Table 39 Top 3 Hardware Providers in the China IoT Market, 2015

Table 40 Top 3 Software Providers in the Market, 2015

Table 41 Top 3 Network Providers in the China IoT Market, 2015

Table 42 10 Most Recent New Product Launches in Market

Table 43 5 Most Recent Acquisitions and Expansions in China IoT Market

Table 44 5 Most Recent Partnerships in China IoT Market

Table 45 5 Most Recent Agreements, Collaborations, Joint Ventures,And Strategic Alliances in Market

List of Figures (70 Figures)

Figure 1 China IoT Market Segmentation

Figure 2 Market: Research Methodology

Figure 3 Process Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Service Market in China IoT Likely to Grow at the Highest Rate During the Forecast Period

Figure 8 Connectivity ICs Expected to Hold the Largest Size of the Market During the Forecast Period

Figure 9 Data Management Software, Device Management Platform, and Professional Services to Dominate the Market During the Forecast Period

Figure 10 IoT Market for Agriculture Application to Grow at the Highest Rate During the Forecast Period

Figure 11 Government Offerings in Terms of Incentives and Standards Expected to Attract Foreign and Domestic Players Toward the Market

Figure 12 Software and Services Would Dominate the Market During the Forecast Period

Figure 13 Connectivity IC Held the Major Share of the Hardware Market; Data Management Software Held A Major Share of He Software Market

Figure 14 Applications Related to the Public Sector Leading the IoT Market in China

Figure 15 Evolution of the Market

Figure 16 Growing Demand for Smartphones and Other Connecting Devices to Drive the IoT Market in China

Figure 17 Number of Smartphone Users in China (2014–2020)

Figure 18 Number of Internet Users in China (June 2011–June 2015)

Figure 19 Average Yearly Wages in the Manufacturing Sector in China(2008–2014)

Figure 20 Increasing Urban Population of China (2010–2015)

Figure 21 Value Chain Analysis: Major Value is Added During the Research, Design, and Development and End User Phases

Figure 22 Porter’s Five Force Model for Market, 2016

Figure 23 Porter’s Five Forces Analysis

Figure 24 Impact of Threat of New Entrants is Currently Medium Because of Favorable Government Regulations and Capital Required

Figure 25 The Threat of Substitutes is Low as IoT is Still in R&D Phase in China

Figure 26 High Supplier Concentration Weakening the Bargaining Power of Suppliers

Figure 27 Bargaining Power of Buyers in Market

Figure 28 High Industry Growth Rate Leads to A High Degree of Competitive Rivalry in the Market

Figure 29 IoT Market Size Comparison: Global vs. China (2014 to 2020)

Figure 30 Smart Home Market Size Comparison: Global vs. China (2014 to 2020)

Figure 31 Home Automation & Security Controls Market Size Comparison: Global vs. China (2014 to 2020)

Figure 32 Smart Thermostat Market Size Comparison: Global vs. China(2014 to 2020)

Figure 33 Smart Lighting Market Size Comparison: Global vs. China (2014 to 2020)

Figure 34 Smart Appliances Market Size Comparison: Global vs. China(2014 to 2020)

Figure 35 Smoke Detector Market Size Comparison: Global vs. China(2014 to 2020)

Figure 36 Occupancy Sensor Market Size Comparison: Global vs. China(2014 to 2020)

Figure 37 Wearable Electronics Market Size Comparison: Global vs. China(2014 to 2020)

Figure 38 Building Automation & Controls Market Size Comparison: Global vs. China (2014 to 2020)

Figure 39 IoT Based Precision Farming Market Size Comparison: Global vs. China (2014 to 2020)

Figure 40 Smart Greenhouse Market Size Comparison: Global vs. China(2014 to 2020)

Figure 41 Intelligent Transportation System Market Size Comparison: Global vs. China (2014 to 2020)

Figure 42 Industrial IoT Market Size Comparison: Global vs. China (2014 to 2020)

Figure 43 Industrial Control & Factory Automation Market Size Comparison: Global vs. China (2014 to 2020)

Figure 44 Smart Factory Market Size Comparison: Global vs. China (2014 to 2020)

Figure 45 Retail Automation Market Size Comparison: Global vs. China(2014 to 2020)

Figure 46 Memory Devices to Witness the Highest Growth Rate in the China IoT Market

Figure 47 Application and Network Security Software Expected to Witness Highest Growth Rate in the Market

Figure 48 Device Management Platform Expected to Grow at the Highest Rate in the China IoT Market

Figure 49 Managed Services to Witness the Highest Growth Rate in the Market

Figure 50 Agriculture Application to Wtness the Highest Growth in the China IoT Market

Figure 51 Growth of the Automotive Sector in China By 2020

Figure 52 Global Companies in the Market Adopted New Product Launches as the Key Growth Strategy Between January 2015 and May 2016

Figure 53 Domestic Companies in the Market Adopted New Product Launches as the Key Growth Strategy Between January 2015 and May 2016

Figure 54 China IoT Market Evaluation Framework

Figure 55 Battle for the Market Share

Figure 56 Geographic Revenue Mix of IoT Players

Figure 57 Huawei Investment & Holding Co., Ltd.: Company Snapshot

Figure 58 Huawei Investment & Holding Co., Ltd.: SWOT Analysis

Figure 59 Mediatek Inc.: Company Snapshot

Figure 60 Mediatek Inc.: SWOT Analysis

Figure 61 Qualcomm Inc.: Company Snapshot

Figure 62 Qualcomm Inc.: SWOT Analysis

Figure 63 Xiaomi Inc.: SWOT Analysis

Figure 64 IBM Corp.: Company Snapshot

Figure 65 IBM Corp.: SWOT Analysis

Figure 66 Microsoft Corp.: Company Snapshot

Figure 67 Alibaba Group Holding Ltd.: Company Snapshot

Figure 68 China Mobile Ltd.: Company Snapshot

Figure 69 China Unicom (Hong Kong) Ltd.: Company Snapshot

Figure 70 China Telecom Corp. Ltd.: Company Snapshot

This research study involves an extensive use of secondary sources such as annual and financial reports of top players, presentations, press releases, journals, paid databases, and interviews with experts. The research methodology is explained below. The China IoT market size has been calculated using the top-down and bottom-up methods. In bottom-up approach, the number of additional components going into a smart devices are calculated, then the number of extra devices is multiplied with the volume of these devices in China to arrive total volume of devices, which is further multiplied by their average selling price (ASP). The top hardware numbers are arrived at, and a similar process is followed for the software, platform, services, and applications. Finally, all numbers are added to estimate the overall China IoT market.

After arriving at the overall market size, the total market has been split into several segments and subsegments and confirmed with experts. The figure below shows the breakdown of primaries conducted during the research study on the basis of company, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The China IoT ecosystem comprises major hardware providers such as Xiaomi Inc. (China), Qualcomm Incorporated (U.S.), MediaTek Inc. (Taiwan), and Huawei Investment & Holding Co., Ltd. (China), network providers such as China Mobile Limited (Hong Kong), China Unicom (Hong Kong) Ltd. (Hong Kong), and China Telecom Corporation Limited (Beijing); and software providers such as International Business Machines (IBM) Corporation (U.S.), Microsoft Corporation (U.S.), and Alibaba Group Holding Ltd. (China).

All these companies have their own R&D facilities and extensive sales offices and distribution channels. The products of these companies can be used across industries. The target audience for the report includes:

- Technology providers

- Raw material and manufacturing equipment suppliers

- Semiconductor wafer vendors

- Fabless players

- Foundry players

- Electronic design automation (EDA) and intellectual property (IP) core vendors

- Original equipment manufacturers (OEMs) (end-user applications or electronic product manufacturers)

- Original design manufacturers (ODMs) and OEM technology solution providers

- System designers and IoT device manufacturers

- Operating system (OS) vendors

- Mobile network operators (MNOs)

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next two to five years for prioritizing efforts and investments.

The market covered under this report has been segmented as follows:

This research report categorizes the China IoT market on the basis of hardware (processor, memory, logic, sensor, and connectivity), service (professional and managed services), by software, platform, and application.

China IoT Market, by Hardware

- Processors

- Memory Devices

- Logic Devices

- Sensors

- Connectivity ICs

China IoT Market, by Software

- Real-Time Streaming Analytics

- Application and Network Security

- Data Management

- Remote Monitoring System

- Network Bandwidth Management

China IoT Market, by Platform

- Device Management

- Application Management

- Network Management

China IoT Market, by Service

- Professional Services

- Managed Services

China IoT Market, by Application

- Consumer Electronics

- Building Automation

- Industrial

- Automotive & Transportation

- Healthcare

- Retail

- Oil & Gas

- Agriculture

- Others

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Hardware Analysis

- Further breakdown of the hardware segment, by sensor

- Further breakdown of the hardware segment, by connectivity

Growth opportunities and latent adjacency in China IoT Market

I am working on a project comparing the IoT statistics of different countries to global IoT statistics and require China's statistics for the same.

Is this report involved the market sizing for IoT-based hardware like processor, Memory, logic, and sensor?